February 25, 2019

February 25, 2019

By Kristine Madsen, MD MPH

Dr. Kristine Madsen, a pediatrician, is the Faculty Director of the Berkeley Food Institute and an Associate Professor at UC Berkeley’s School of Public Health.

For almost a decade, I worked as a physician in a pediatric obesity clinic. Children from diverse neighborhoods showed up in my exam room every week. I diagnosed diabetes too many times, but most children were not yet affected by the complications of obesity. While those complications would certainly come later, I spent little time practicing medicine in clinic; mostly I counseled patients and families to make choices they largely couldn’t afford. I was essentially putting band-aids over the symptoms of a larger problem—a system that had steadily been creating sick kids for over three decades. So I left clinical practice to address the system that was creating these sick kids.

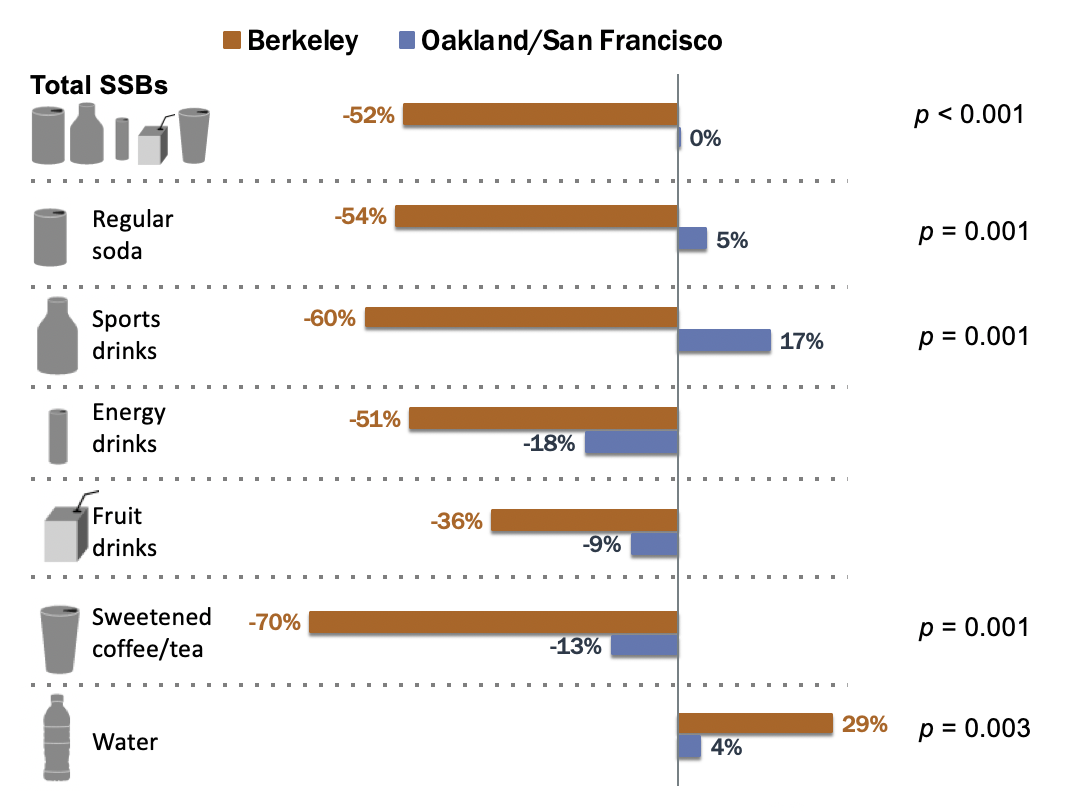

Residents reported drinking fewer soft drinks like Coke and Pepsi, sports drinks like Gatorade and Powerade, and sweetened teas and coffees. Graphic by Kristine Madsen.

After working in UC Berkeley’s School of Public Health now for seven years, I have come to the conclusion that soda taxes are a critical lever in the fight to reduce the ultimately life-threatening impacts of diet-related disease. Sugary drinks are the only dietary item that’s been shown to cause obesity, and put simply, taxing sugar-sweetened beverages works. Our just-released study in the American Journal of Public Health presents the first long-term results of a sugar-sweetened beverage (SSB) tax in a U.S. city. Among residents of diverse neighborhoods, we saw a 52% decline in SSB consumption over the first three years of Berkeley’s one-cent per ounce SSB tax. Our earlier study showed a 21% decline within the first six months of the tax. Mexico, which instituted a nationwide tax in 2014, similarly saw decreasing consumption over the first two years of its tax. Since 2016, multiple jurisdictions have passed similar taxes, including Philadelphia, which saw a 26% decline in consumption just two months into its tax.

While some people have suggested that SSB taxes create a “nanny state” in which government interferes with personal choice, this assertion ignores the billions of dollars the beverage industry spends on marketing every year to influence our behavior. Children in the U.S. (and increasingly, the world), are born into a media landscape saturated with slick, colorful, and relentless advertising for junk food. SSB tax revenues can fund counter-messaging to educate residents about the dangers of consuming sugary drinks. Bay Area cities are also using SSB tax revenues to build the capacity of grassroots community groups to develop solutions to the epidemics of diabetes and obesity. For some, this means gardening and cooking programs. For others, it means refurbishing public water fountains, ensuring that everyone has access to clean, safe drinking water.

Obviously, the beverage industry doesn’t like SSB taxes and it is not surprising that they have invested millions of dollars trying to block them. Far more concerning however, were the American Beverage Association’s actions in 2018, which thwarted the democratic process in California, making it impossible for citizens to vote on any new, local SSB taxes until 2030. This is known as preemption and should alarm anyone interested in public health or political transparency.

We need all options available to us to combat obesity and diabetes, which are at an all-time high in the U.S. Taxes were a cornerstone of the public health movement that successfully reduced cigarette smoking by over 50%. Fortunately, California’s preemption of local taxes doesn’t affect statewide legislation, and the California Medical and Dental Associations are working with the American Heart Association to put a statewide SSB tax on the ballot in 2020. Such a tax has the potential to raise significant revenues to improve the health of children and increase health equity. With input from communities most affected by the advertising of unhealthy products and by diet-related disease, SSB tax revenues should focus on dismantling the system that has created our obesity and diabetes epidemics. Otherwise we’re just putting band-aids on a deadly disease.